There is a lot of intricate logistics involved in international trade, which needs fair knowledge on the terms and responsibilities involved in shipping. Two of the most important Incoterms in international trading, including cost and freight cfr, are CFR (Cost and Freight) and CIF (Cost, Insurance and freight) – these two Incoterms make a great difference in the manner by which goods are transported and the liability of different costs as well as who is to bear what risk between the buyer and the seller.

Company information GWT Worldwide Shenzhen Guanwutong International Freight Forwarding Co., Ltd. (GWT Worldwide) is a freight forwarding service provider company based in the field of global freight forwarding, global supply chain solutions, and cross-border electronic commerce logistics. GWT Worldwide has professional knowledge and experience in Air Freight & Sea Freight, China-Europe Railway Transport, International Express & Courier Solutions, Customs Clearance & Warehousing, and Amazon FBA Shipping & Labeling Support. We provide high level of commercial and customized services based on professional knowledge and experience and we are using advanced technologies and a balanced network of reliable partners all over the world.

Understanding Incoterms: The Foundation of International Trade

The shortened form of International Commercial Terms is incoterms; they are published commodity terms released by International Chamber of Commerce (ICC) which state the roles of buyers and sellers in international commerce. The terms determine who has to bear the shipping costs, the insurance costs, the customs duties and the other charges in the process of transporting goods between the seller and the buyer on an international basis. The main difference between CIF and CFR shipping terms is insurance..

The major role of Incoterms is to eradicate confusion and controversies with well-defined obligations of each party about delivery, shifting of risks as well as distribution of costs. In the absence of such uniform terms, international trade would become much more complicated and marked with possible misreadings and subsequent conflicts leading to the problems rather expensive in its turn.

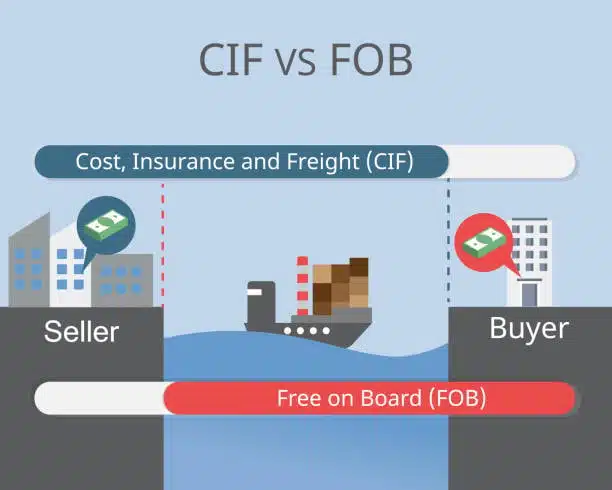

Both CFR and CIF are maritime logistics terminologies that are used when transporting goods through the sea as well as by the inland waterways. The two terms have the seller arrange and meet the cost of the main carriage of goods to the named port of destination; the difference between the two terms, including freight cfr, lies in the type of Insurance cover and risk allocation framework between them.

What is CFR (Cost and Freight)?

Cost and Freight known as CFR is an Incoterm which involves the seller paying the costs and the charges involved to transport goods to the port of destination in the named port. Under the CFR terms, the seller’s responsibility is to contract and pay the main carriage by the sea to the specified destination port, but the transfer of risk of loss or damage to the buyer James takes place at the moment when the goods crosses the rail of the ship at the port of shipment.

What this implies is that the seller assumes the cost of shipping to the shipping vessel at port of destination but the buyer bears all the risks during the sea journey. The responsibility of the seller ceases when the load is shipped onto the vessel in the shipping port; the seller would still cover the freights until the delivery port via the shipping charges.

CFR is best applicable to such transactions under which buyer has easier accesses to marine insurance or desires to take his/her own insurance arrangements. This term provides the buyers with greater control in the process of making insurance decisions without leaving the parties to deal with the logistical complexities of making international shipping arrangements.

What is CIF (Cost, Insurance, and Freight)?

CIF Cost, Insurance, and Freight is also an Incoterm and is also like CFR but one significant difference is that in CIF, the seller should also arrange and pay for additional insurance, including marine insurance, to insure the risk of loss or damage of the buyer. At CIF terms, the seller has to bear the cost of goods, freight expenses until the declared port of destination as well as marine cover.

The insurance cover that falls under the CIF terms becomes a minimum of 110 percent of the contract value and it has to be in the currency of the contract. The insurance costs affect how t insurance ought to cover goods between the point of shipment and not less than port of destination offering protection against the dangers of loss or damage incurred in transit across the sea.

Similar to CFR, the risk transferring point in the CIF is not at the port of destination but at the port of shipment where the goods have crossed the rail of the ship at the port of shipment. This implies that the seller will take the insurance cover but in the real sense, it is the buyer who is the real owner of the insurance policy who has to make any claims with the insurance company.

Key Differences Between CFR and CIF

Insurance responsibility is the basic difference between CFR and CIF. Under CFR, the buyer has to organize and pay marine insurance that will cover against damages or loss of goods in transit. The seller will have to acquire and settle this insurance cover under CIF but the buyer will still be the beneficiary.

The difference between these terms in cost implications is quite high. CFR generally leads to a reduction of quoted prices including transportation costs because the seller does not carry the cost of insurances in its prices. Insurance premiums are charged under CIF prices, and such costs might be more money than a buyer might have got individually; however they save time because the insurance service is guaranteed of coverage.

Insurance decision control varies in a significant way. Under CFR, customers are able to choose the insurance company with whom they want to take insurance, the coverage limits and the term of the policy depending on his/her own requirements and appetite of risk. In CIF the buyer must come to terms with the insurance cover laid out by the seller and this can be contrary to what the buyer wants in terms of insurance cover or the cover that the given buyer has.

Risk Allocation and Transfer Points

CFR and CIF use the same point of risk transfer, the shipment of goods which clears the rail of the ship at locale of the shipment. This is one of the important notions which fail to be understood by traders, because, even though the seller can incur the transportation and insurance costs, to the destination port, the buyer will risk at a much earlier point of the shipping process.

The practical implication of this is that in the event that the goods become damaged or even lost in the course of the sea journey, the customer will foot the financial impact, under CIF terms as well. The point of difference is that in CIF the buyer is covered in insurance purchased by the seller whereas in CFR the buyer has to either have taken their own insurance cover or face the financial loss all alone.

The issue of risk transfer at this point is very important to the buyers and sellers when deciding on proper Incoterms to use. The sellers must make it clear that their responsibility stops at the port where the shipment is made and the buyers must be ready to take the goods over during the sea transit.

Cost Responsibilities Under CFR Terms

Under the CFR contracts, the seller is bound to meet certain costs of transporting goods until the named port of destination. They are the cost of goods, export packaging depending on the requirements of the intended journey, cost of customs clearance of the goods at the export country and other freight related charges, cost of getting the goods to the highway carrier in the country of export at export port of shipment and total freight charges to the named port of destination buyer’s inventory costs.

Selling costs of loading (terminal handling charges, loading port fees and other costs incurred in loading goods into the ship) at the port of shipment must also be paid up by the seller. These expenses may be quite high and ought to be considered in pricing when charges offered under CFR terms buyer assumes.

With CFR terms, the buyer’s costs begin with covering marine insurance, importation customs duties/clearance, unloading costs in the destination port, further transportation of the goods beyond the destination port and all the further handlings and storage costs once the goods are received at the destination port.

Cost Responsibilities Under CIF Terms

CIF terms extend the cost burden of the seller to marine insurance besides all the costs covered by CFR terms. The seller will have to purchase insurance, specifically marine insurance, where the risk of the buyer in case of loss or damage is covered during transit and a minimum of 110 percent of the value of the contract should be the insurance coverage own additional insurance arrangements.

The insurance will have to be taken with reputable underwriters or insurance companies under a policy that will cover the same risks that are covered under the Institute Cargo Clauses (A) of the Institute of London Underwriters or under some other equivalent conditions. The policy must be of same currency in which the contract is and the policy must be transferable to the purchaser.

The costs that buyers using CIF terms are obligated to pay are less than their counterparts using CFR because they do not have to settle marine insurance. They still however have the responsibility of import customs clearance, cost of unloading the goods at their destination, costs of transporting this forward, and any other handling or storage costs once they are received.

Insurance Considerations and Requirements

Marine insurance is important when treating the distinction between CFR and CIF purchase insurance coverage. When buyers have to pay out of pocket to buy marine insurance as per CFR, buyers have total control over the coverage levels, deductibles and terms of the policy as well as its breach and claims procedures. Through this control, a buyer can incorporate cargo insurance and use the current insurance programmes and may even enjoy better rates based on volume discounts.

CIF terms mandate sellers to offer marine insurance cover but it is in most cases basic and might lack some of the requirements by the buyer. The 110 percent, the US requirement minimum coverage rate offers limited protection against the fluctuations of currency exchange and other expenditures, but buyers are faced with an issue of needing extra coverage coverages or increased coverage limits on mac specific risks freight costs.

The process of claims handling varies in CFR and CIF schemes. In CFR, the purchasers deal directly with the insurance company of their choice, whereby they are likely to have built relationships or know the processes involved. Buyers are forced to collaborate with the insurance provider of the seller under CIF, which might compromise claims procedures and communication.

Documentation and Administrative Processes

The CFR and CIF terms entail special documents that are needed in making successful international trade. Exporters must forward commercial invoices, packing lists, bills of lading or sea waybill, export permits or licences (where necessary) and certificate of origin. Sellers under CIF terms are also required to insure under insurance policies or certificates indicating details of coverage.

Under both terms, the bill of lading is used as the main transport document, it furnishes evidence of the contract of carriage and acts as a document of title. Buyers ought to inspect bills of lading thoroughly to make sure they represent accurately shipped goods and contain the necessary endorsements needed to transport the goods anywhere, or deliver them inland waterway transport.

CIF has a special concern to insurance documentation. Sellers should issue insurance policies or certificates stating clearly that the buyer is the one to receive benefits, also, they should carry appropriate endorsements that on their part allow claims to be handled properly and they should have many details on the coverage terms and the conditions of coverage made.

Practical Applications in Different Industries

The terms of CFR and CIF have been practiced in different industries and have a number of considerations and preferences. CFR in the automotive business, is especially common with high value freight where the buyer would prefer choice as to the insurance and settlement of claims. Buyer-arranged insurance is more preferable due to the complexity of automotive parts and how specialized coverage is required related costs.

Smaller shipments in the electronics business are often priced on CIF terms because the cost of the seller arranging insurance is small compared to the possible savings the buyer could achieve by making his own arrangements. But when high value electronics are concerned, CFR can be used instead of CIF to provide proper coverage of sophisticated items buyer’s risk.

The CFR terms are common in commodity trading especially when shipping in bulk when buyers have their own contacts with the marine insurance company and they opt to control their own risks. The companies in manufacturing industries can either adopt the CFR or CIF depending on the internal strength of the company and their risk management tactics sales contract.

Common Pitfalls and How to Avoid Them

There are a few errors which might make things complicated in CFR and CIF transactions. The commonest mistake is to misunderstand the risk transfer point, as the parties would believe that the risk is transferred upon arrival at the destination port as opposed to transferring the risks of the port of shipment. Such confusion may amount to insufficient insurance covers and hot-potato liability to damages buyer pays.

Poor cover of insurance on CFR terms may lead to major losses in company. The buyers need to make sure that they secure all inclusive marine insurance and include any risks that may occur during the shipment, such as sharing a general average, salvage costs and loss occasioned by the delay. Not getting good cover might leave a person with a great deal of out-of-pockets risk occurs.

To buyers working on CIF terms, there is the assumption that there is full protection on insurance arrangements made by sellers and the minimum cover requirements will not be adequate on high value or specialized cargo. Misrecorded data may reduce delivery times and cause non-compliance problems. All documents must be precise, supported and acceptable by all parties concerned commercial invoice.

Choosing Between CFR and CIF for Your Business

A choice of CFR and CIF is made on a number of factors specific to the business and a transaction. The possibility of saving that may come with CFR as compared to the control it offers to companies with built-in marine insurance relationship and claims experience can be the reason why companies would make use of CFR. CFR can also be attractive as far as the possibility of integrating cargo insurance within the current insurance programs is concerned icc’s tax payment cif and cfr.

It is possible that new firms involved in international trade or a firm that does not seek insurance expertise would prefer CIF, in which the seller takes charge of insurance. These businesses are however ready to deal with new insurance providers and might have to spend some time to learn about coverage terms and filing claims insurance protection.

When making the decision, cost factor is a major consideration. CFR enables buyers to compare competitive insurance rates and even make saving especially in case of regular shipments. CIF can be more expensive in total amounts price but it is convenient and covers are sure to be taken. The ability to manage risk and the level of overall risk tolerance are also a factor in decision seller’s obligation.

Impact on International Trade Finance

CFR and CIF differ in their scope of influence regarding the trade finance setup especially in letters of credit and documentary collections. The requirements of banks concerning CFR and CIF transactions might vary and an influence on the documentation necessary and the time it takes to get the payments once they were ordered may occur.

Letters of credit, which are normally used under the CFR terms, lack the requirement of insurance documents making the documentation process less complicated with an aspect of burden on buyers as they have to hire their own insurance coverage. The above separation may impose difficulties when financial contract arrangements are to be made where the banks seek insurance cover certification as a prerequisite to making the payments.

In the standard document set in CIF terms, there will be insurance documents, which can simplify the process of letters of credit but can also be a cause of complexity should the insurance documents be subject to amendments or have some discrepancies. Different terms can have an effect on financing options and cash flow potential as far as the cost consequences are concerned.

Conclusion

Selection of either CFR or CIF term is one of the fundamental trade terms used in international business which influences costs distribution, risk, and the roles and responsibilities carried out by the various parties. The CFR terms enable buyers to be more in charge of insurance arrangements and they may be cost effective, however involving more expertise and administrative work in implementing them. CIF terms are convenient and provide a high level of unemployment protection; however, they can be costly and can lead to decreased control over the decision making regarding the insurance costs.

Thank you for reading!

Have questions, corrections, or better ideas? We’d love to hear from you!

We value every piece of feedback and promise to reply within 24 hours. Let's make this guide better together!

Note: Spam comments will not be published.