CIF Meaning: A Comprehensive Guide to Cost, Insurance, and Freight Terms in International Trade

For a business to do well in international trade, knowing shipping terms is very important. CIF is considered one of the Incoterms that every exporter and importer should learn. This guide explains what CIF is, how it functions and why it matters for global business.

What Does CIF Mean in Shipping and Trade?

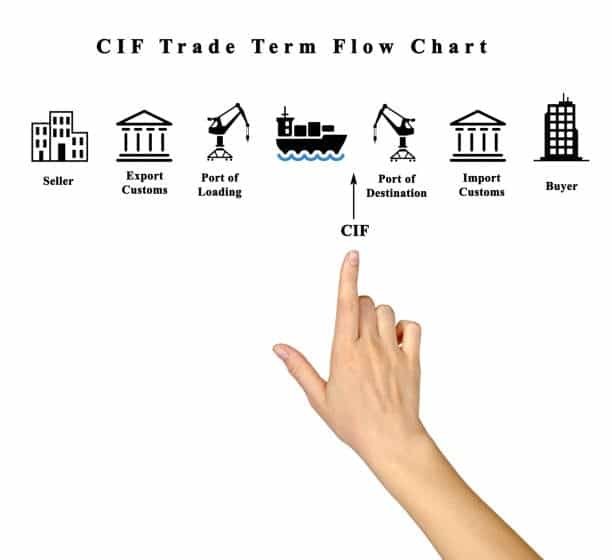

Cost, Insurance and Freight are the main components that CIF covers. It serves as one of the eleven Incoterms (International Commercial Terms) introduced by the ICC to help make international trade consistent. If the contract is a CIF, the seller is responsible and needs to pay for the goods, their insurance and the shipment expenses to the buyer’s preferred port.

Since shipping is the seller’s job, buyers who want to remain uninvolved can find this a good option. Unlike other Incoterms, the CIF term is meant just for sea and inland waterway shipment, where the buyer assumes certain risks .

CIF evolved from the long-standing practices around maritime trade. Because international commerce grew, it became easy to see that everyone needed standard terms, so formal Incoterms were introduced in 1936. Because it neatly describes who is responsible for what, CIF is still one of the most widely used terms.

Understanding CIF Responsibilities and Risk Transfer

CIF obligations go further for the seller than just manufacturing or obtaining the goods. It is the seller’s responsibility to pay for the shipment of goods to their destination port, arrange marine insurance for not less than 110% of the contract price to ensure adequate insurance cover and deal with export customs, paperwork and other processes. and deal with export customs, paperwork and other processes.

During the shipping process, risk transfer is very important. The risk of losing, stealing or breaking the goods passes from the seller to the buyer after the shipment is loaded onto the vessel at the dock. Buyers face this risk simply because they have the goods in their possession, though they have not yet covered the transport or shipping insurance bill.

The buyer must arrange and pay for all the import clearance, duties and taxes needed upon arrival of the goods at the destination country. Cargo ships have to complete unloading at the port of destination and arrange for the next movement of goods to their own sites. Additionally, buyers have to know that paying freight charges and filing a claim for lost or damaged goods during the move is usually directly with the insurance carrier.

CIF vs Other Incoterms: Key Differences Explained

Exploring CIF with other prominent Incoterms explains the situations when CIF should be used. FOB (Free on Board) is the main opposite of CIF in international sales. If the deal is FOB, the buyer must pay for freight and insurance and risk is transferred from the owner to the buyer at the same point as with CIF – when goods leave the ship at the port.

The cost and freight (CFR) term is mostly similar to CIF, the only difference is that insurance is not covered. The seller covers the customs and transportation costs to the port, but he will not pay for insurance which buyers must arrange themselves. Such a difference may result in significant financial loss if products get damaged during travel.

CIP (Carriage and Insurance Paid To) stands as the substitute for CIF in all transport sectors, besides only maritime transport. For CIP, goods are handed to the first carrier to take on the risk which protects buyers more than when goods are handed over for CIF.

Under DDP (Delivered Duty Paid), sellers take on all the work and costs associated with getting the goods delivered to the buyer’s place and handling the necessary import taxes and duties. Choosing this method within an international shipping agreement makes it easy for buyers, but it usually makes products more expensive.

Advantages and Disadvantages of CIF Terms

Many advantages of CIF are appealing to buyers taking part in international trade. A major benefit is that sellers manage the complex shipping processes, so buyers can work on their main business activities. Such an arrangement is most helpful for small businesses, giving them more control, that do not have much knowledge or connections in the logistics and insurance fields.

The ability to calculate future expenses easily is also appreciated by organizations. The buyer is given quotes that include all shipping costs to the destination port which makes it easy for them to set a budget. By obtaining insurance, you can feel even more assured since the items are covered if any damage happens on the way.

On the other hand, CIF terms have some important flaws. Customers lose decision-making power over either the carriers or the way their goods are shipped which may affect performance. The insurance costs offered by sellers might insufficiently secure some types of risks or not give enough coverage for your costly shipment.

There can be issues with seeing the true costs under CIF conditions. Freight and insurance prices to the named port may be greatly overvalued by sellers which makes it hard for buyers to understand their true costs. Insurance buyers might get stuck working with claim agents from insurers they didn’t pick which can be inconvenient when trying to settle damage claims.

CIF Documentation and Procedures

Correct documentation is key to a successful CIF transaction. Sellers are required to give buyers the important documents and to ensure the seller pays, which are the commercial invoice, packing list, bill of lading and insurance policy or certificate. Bills of lading assist with customs inspections, making insurance claims and all payment-related processes.

Special consideration should be given to the bill of lading which acts as proof of goods loaded, a contract for the voyage and proof of ownership. According to CIF, bills of lading are normally given in consignment to the buyers or the agents listed by the buyers.

The sales contract outlines the specific rules for what insurance documentation should look like. To be safe, the insurance coverage should be 110% or more of your CIF and shield against marine issues all through the transit period. Sellers should arrange for the coverage to begin as goods cross the rail of the ship and end when the goods reach the destination port.

Frequently, letter of credit deals use CIF terms within international shipping agreements and depend on accurate paperwork for the funds to be freed. Bankers examine all documents closely, so having complete and correct information is very important. Any problems with the documents can result in your payment being rejected or taking longer which is why you need to be careful when preparing them.

Insurance Considerations Under CIF Terms

CIF insurance is usually based on Institute Cargo Clauses which give details about the coverage and exceptions. Institute Cargo Clauses (A) give you the widest protection by including coverage for all risks, except the ones that are clearly stated as exceptions. The insurance covers damage caused by accidents, natural events and general average payments.

Institute Cargo Clauses (B) and (C) only provide for certain risks instead of providing comprehensive protection for all damages. People on both ends of any contract should be specific about the insurance needed, so no problems or insufficient protection arise later.

Under CIF, the sum payable under insurance should not be less than what would cover the goods, transport expenses and a ten percent buffer. The extra margin is there to handle unplanned costs and possible losses from damaged goods.

Buyers need to be aware of their job in processing insurance claims under a CIF contract. Sellers have to buy insurance and pay the costs, but buyers usually need to take the next step of filing a claim for what was damaged after they purchase insurance . Alertness to expect claims and good claim documentation increases the chances of a successful outcome.

Common CIF Mistakes and How to Avoid Them

Commonly, people mix up when they should transfer risk. People expect their goods are covered until they reach the port of destination because insurance and freight cost is covered by the sellers. However, risk passes to buyers when goods are shipped, so they are liable for any issues during transit because they are not in control of the shipping.

Many do not have the proper insurance policies and this is also a typical risk. Marine insurance for standard use may exclude some possible dangers specific to what is being traded and through which routes. Those who are buying goods should read the policy information and add supplemental coverage to valuable or sensitive shipments if necessary.

If documentation is not correct, it can hold up the project and increase expenses. Sellers should ensure that all their paperwork is accurate, complete and matches. A lot of the time, issues are found in failing to give the correct consignee info, skipping endorsements or not describing goods adequately.

A lack of effective communication between traders usually results in unclear responsibilities and expectations. Better outcomes are achieved when all obligations, policy details and how the contract is handled are clearly listed.

Digital Transformation and Modern CIF Practices

Technology keeps changing how CIF transactions are conducted in international trade. Electronic bills of lading are being used more often which helps speed up the process and make transactions safer. Thanks to digital technology, documents can be exchanged, followed and payments processed faster than before carriage paid.

Blockchain is expected to change how trade documentation is handled by making records unchangeable and carrying out contracts automatically. Due to these innovations, fraud could drop, transactions could be made more quickly and it could be cheaper to process and verify documents buyer’s responsibilities.

Being able to pick up cargo information in real time supports openness and less risk under CIF terms. Buyers are able to keep an eye on the movement of their goods and receive notifications if there are delays or problems which gives them direct access and allows them to deal with issues right away insurance and freight cif.

Digital options are becoming available to give people more flexible and adaptable insurance benefits. Because of this such platforms can change their costs based on shifting risks and easily process claims by finding and analyzing damages automatically customs clearance.

Regional Variations and Cultural Considerations

How CIF is implemented can be very different in different parts of the world. In Asia, since exporters and logistics firms are well-connected, CIF is usually the preferred way of business, whereas in Europe, CFR or FOB are widely used based on the type of commodity being traded free carrier.

Culture shapes the way CIF negotiations and implementations take place. Businesses with a focus on relationships may enjoy preferential contract terms, low-rate shipping and thorough insurance through long-term cooperative efforts cargo arrives. Alternatively, transaction-oriented cultures might pay closer attention to quick cost savings and precise contract details cif means.

The way organizations interact with the law can play a role in their CIF practices. Certain points in the law might be interpreted differently in common law countries than in civil law jurisdictions, changing how disputes are settled and laws are enforced. Considering the laws that govern your business, traders should write the CIF agreement and add clauses specifying the court or country where any issues might be resolved air freight.

The way local customs operate can have a big impact on how well CIF works. The steps and documents needed for export and import along with payment types are not the same in every country which means traders must be flexible. It helps to work with knowledgeable local partners or agents to deal with these differences.

Future Trends in CIF Trading

More businesses are including elements of environmental sustainability in CIFs to lessen their carbon emissions. More and more, choosing a carrier and negotiating contracts involves looking at green initiatives, alternative types of fuel and carbon offsetting plans.

There has been a rise in attention to supply chain resilience because of recent disruptive events. Companies may include more options for shipping routes, different carrier deals and better ways to handle risks so their supply chains do not get interrupted international chamber.

New legal rules keep appearing such as those relating to how suppliers are selected and reported on, system security and the environment. These contracts have to change in line with the new requirements so they stay commercial and effective insurance claim.

Logistics and insurance sectors are using artificial intelligence and machine learning which helps CIF services to predict risks, automate assessments and provide customized coverages. Such technologies could bring about CIF agreements that are more affordable and more effective in the future final destination.

Conclusion

CIF is central to international trade, offering a detailed way for putting the risks, duties and costs on buyers and sellers. Although CIF is easy to use and reliable for buyers, it takes great knowledge of its policies, timing of risk transfers, required insurance and needed paperwork to make it work properly. With improvements in technology and changing market conditions, CIF terms will probably change, but they will still be central to international business.

Thank you for reading!

Have questions, corrections, or better ideas? We’d love to hear from you!

We value every piece of feedback and promise to reply within 24 hours. Let's make this guide better together!

Note: Spam comments will not be published.