20-Foot Container from China to Japan 2025 Guide

By Guanwutong / November 7, 2025

In the post-pandemic logistics landscape, search interest for “20-foot container from China to Japan” has surged. Importers and logistics managers are fundamentally reassessing their cost structures, route efficiencies, and supplier strategies.

This is not another article just listing ocean freight rates. This guide delivers practical, decision-ready guidance for anyone moving goods from China to Japan. We will expose The 20-Foot Paradox: the common and costly misconception that the 20-foot container is the cheapest option just because its headline price is lower. The truth is, it’s often more expensive and operationally inefficient.

By the end of this guide, you will understand when a 20-foot container makes economic sense, how to calculate its true total landed cost, and which operational choices—FCL vs. LCL, standard vs. high-cube, or even a 40-foot container—will yield the best long-term outcomes for your business.

1. Why the 20-Foot Container from China to Japan Matters Now (And Why It’s a Trap)

The 20-foot container (TEU) is the baseline of maritime trade. But its role in the China-Japan lane is complex, driven by a critical paradox.

The 20-Foot Paradox: Perception vs. Reality

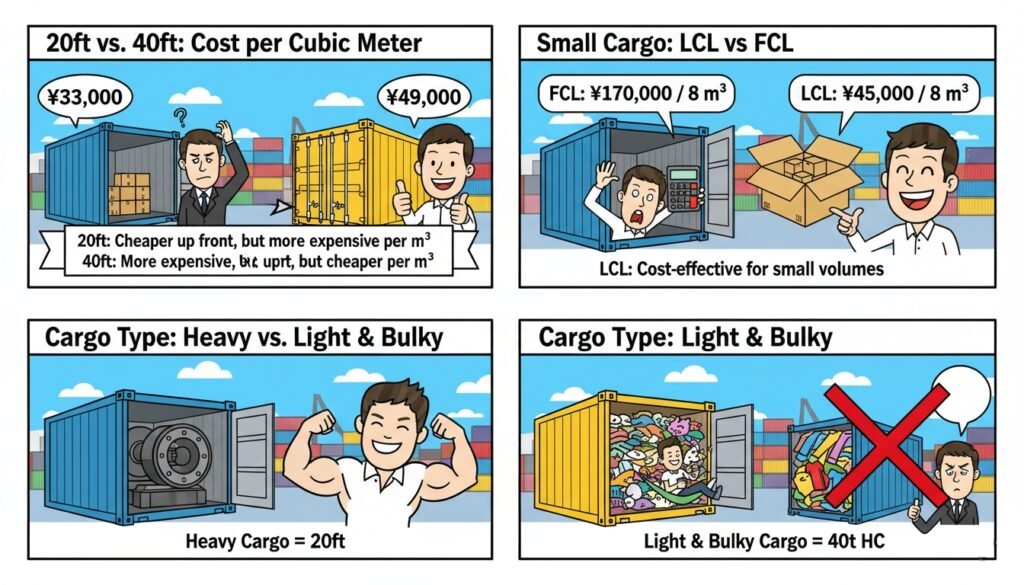

Importers are drawn to the 20-foot container because, in absolute terms, its ocean freight is cheaper than a 40-foot unit. Our data shows a 20ft container’s base cost is often around 67% of a 40ft container’s cost.

Here is the trap: that 20ft container only provides 49% of the dimensional capacity.

| Metric | 20-Foot Container | 40-Foot Container |

| Base Shipping Cost (Example) | ¥33,000 | ¥49,000 |

| Dimensional Capacity | 33 m³ | 67 m³ |

| Cost per Cubic Meter | ~¥1,000 | ~¥730 |

The result: You are paying a 37% premium per cubic meter for the “cheaper” 20-foot option, making it highly inefficient for volume-dependent cargo.

Market Dynamics: The Japanese Drayage Crisis

The paradox is amplified by on-the-ground logistics. Japan faces a severe domestic drayage (trucking) driver shortage. A driver has to choose between:

Hauling a 20ft container for ~¥29,025 (100km).

Hauling a 40ft container for ~¥40,200 (100km).

Both trips take the same driver, similar dock time, and the same paperwork. The 20ft container is simply less profitable for the carrier. This leads to booking refusals, minimum service fees, or carriers applying 40ft drayage rates to 20ft loads just to make it viable.

Strategic Implications

The 20-foot container is not obsolete, but it is specialized. It remains the perfect choice for weight-dominant cargo (like heavy machinery or metal parts) where you hit the 20-24 ton weight limit long before you run out of space. For most other importers, it’s a strategic decision that demands careful calculation.

Core Specifications and Performance of the 20-Foot Container

Geographic and Economic Significance

Before calculating costs, you must know the tool. Here are the official specifications.

| Specification | 20-Foot Standard Dry Container | 20-Foot High-Cube (HC) Container |

| External Length | 6.05m (19’10”) | 6.05m (19’10”) |

| External Width | 2.43m (8’0″) | 2.43m (8’0″) |

| External Height | 2.59m (8’6″) | 2.89m (9’6″) |

| Internal Length | 5.86m (19’2″) | 5.86m (19’2″) |

| Internal Height | 2.38m (7’10”) | ~2.68m (8’10”) (Varies) |

| Usable Volume | ~33 m³ | ~39.7 m³ |

| Tare Weight | 2.1 – 2.5 tons | 2.3 – 2.7 tons (Slightly heavier) |

| Max Payload | 20 – 24 tons | 20 – 24 tons |

When to Use a 20-Foot High-Cube

The 20-foot High-Cube is a lesser-known but powerful option. It offers approximately 20% more volume for bulky, low-density cargo like textiles, footwear, or electrical appliances. While the ocean freight is higher (often +33%), it may be the perfect solution if your cargo consistently “cubes out” a standard 20ft container at 27-30 m³.

For any questions, feel free to contact GWT Shipping. Our team will provide professional, standards-compliant advice tailored to your specific needs.

3. Total Cost of Ownership (TCO) for 20-Foot Container Shipments

The biggest mistake an importer can make is confusing the “ocean freight” quote with the “total cost.” The ocean freight often represents only 40-50% of your final bill.

A true landed cost calculation includes:

Ocean Freight: The base rate plus surcharges like BAF (Bunker Adjustment Factor).

Origin Port Charges (China): Document fees, CY (Container Yard) charges, export customs fees, Port Security Fee (PSF), and handling. (Subtotal: ¥27,000-56,000).

Destination Port Charges (Japan): Terminal Handling Charge (THC), port authority fees, documentation fees, and broker fees. (Subtotal: ¥38,800-66,000).

Import Clearance: Japanese Customs broker fees (¥11,800-20,000), plus duties (based on HS Code) and consumption tax (10%).

Drayage/Delivery: The “problem cost.” A short 30km drayage from Yokohama to Tokyo can be ¥40,000-50,000.

Optional/Hidden Costs: Insurance, warehousing, demurrage (late fees), inspection fees (¥15,000-50,000 if selected), and fumigation.

Practical TCO Example: Shanghai to Tokyo via Yokohama

Here is a real-world TCO breakdown for a standard 20ft container:

| Cost Component | Amount (¥) | Amount ($) |

| Ocean Freight (Base) | 58,000 | $400 |

| Surcharges (BAF, Port Security) | 8,800 | $60 |

| China Port Charges | 40,000 | $270 |

| Japan Terminal Handling (THC) | 28,000 | $190 |

| Japan Customs Clearance | 15,000 | $100 |

| Japan Customs Broker Fee | 18,000 | $120 |

| Drayage (Yokohama to Tokyo) | 45,000 | $300 |

| Total Estimated Landed Cost | ¥222,800 | $1,500 |

Key Insight: The ¥58,000 ($400) ocean freight quote ballooned into a ¥222,800 ($1,500) total cost. Many of these fees (THC, Drayage, Broker) are fixed, meaning they don’t scale down with the container size, further eroding the 20ft’s “cheaper” price.

4. FCL vs LCL: Choosing the Right Option

The 20-Foot Paradox doesn’t just apply to 40ft containers. It’s also critical for deciding between FCL (Full Container Load) and LCL (Less Than Container Load).

FCL (Full Container Load): You lease the entire 20ft container. Ideal for consistent volumes and lower handling risk.

LCL (Less Than Container Load): You share a container with other shippers and pay by Revenue Ton (R/T) — the greater of your cargo’s weight (tons) or volume (m³).

So, when does it become cheaper to book a whole 20ft FCL instead of paying for LCL?

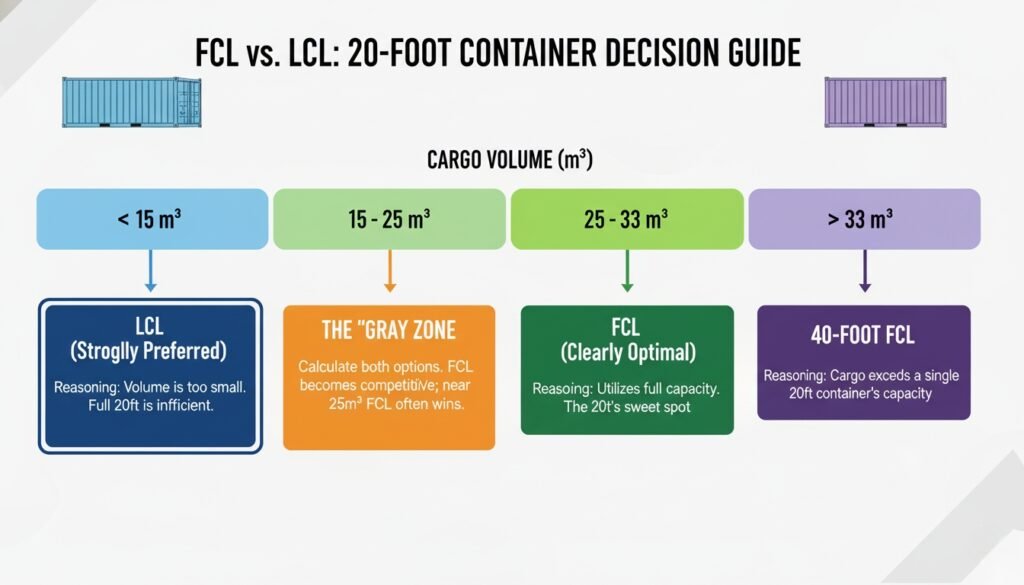

The FCL vs. LCL Breakeven Analysis

| Cargo Volume | Best Option | Reasoning |

| < 15 m³ | LCL (Strongly Preferred) | Your volume is too small. Paying for a full 20ft container is highly inefficient. |

| 15 – 25 m³ | The “Gray Zone” | FCL is becoming competitive. You must calculate both options. As you approach 25m³, FCL is almost always the winner. |

| 25 – 33 m³ | FCL (Clearly Optimal) | You are utilizing the container’s full capacity. This is the 20ft’s sweet spot. |

| > 33 m³ | 40-Foot FCL | Your cargo exceeds a single 20ft container’s capacity. |

LCL has hidden costs, too, including slower de-consolidation (3-5 extra days) and higher handling risk. But for small or irregular importers, it is the correct strategic choice.

5. Market Dynamics, Risks, and Mitigation Strategies

The 20-foot container’s viability is constantly shifting. Here are the key risks and how to manage them.

Industry Dynamics:

Drayage Capacity: As mentioned, driver shortages make 20ft containers a low-priority, high-cost item for domestic trucking.

Rate Harmonization: Some carriers are simply charging 40ft rates for 20ft service to make it worth their time.

Seasonal Fluctuations: Peak season (April-September) can add 10-25% in surcharges.

Strategic Mitigation Steps:

Consolidation (Micro-LCL): Partner with other importers at the same origin port to share a 20ft or 40ft FCL, splitting the costs.

Seasonal Planning: Use LCL for your off-season, irregular shipments and consolidate into FCL during your peak season to smooth costs.

Supplier-Location Optimization: Source from suppliers located near each other or near the same port (e.g., Shanghai and Ningbo) to create a single, efficient FCL shipment.

Explore Alternatives: Don’t just default to the standard dry container. Ask your forwarder about High-Cube (for volume), Open-Top (for oversized machinery), or Reefer (for temperature-sensitive) options.

6. Practical Scenarios: When 20-Foot Works and When It Fails

Let’s apply this TCO and paradox framework to three real-world cargo profiles.

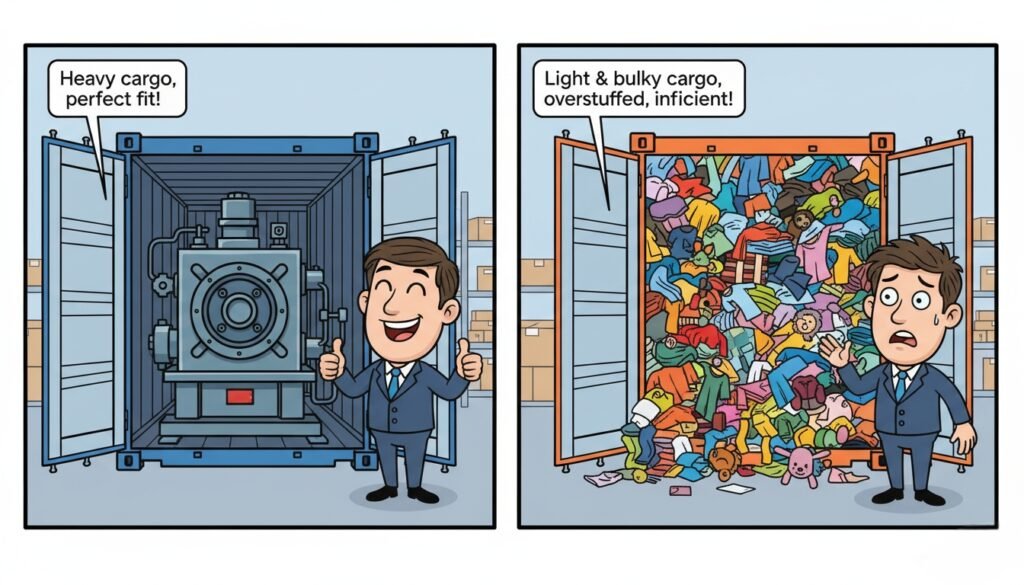

Scenario A: The WIN (Heavy, Compact Cargo)

Profile: Manufacturing company importing steel bearings and motor parts.

Cargo: 18 m³, but 13.5 tons.

Analysis: This cargo is weight-dominant. They will hit the 20-24 ton weight limit far before they fill the 33 m³ of space. Using a 40ft container would be a massive waste.

Conclusion: 20-foot FCL is the optimal, most cost-effective solution.

Scenario B: The FAIL (Light, Bulky Cargo)

Profile: Fashion retailer importing clothing and footwear.

Cargo: 28 m³, but only 5.6 tons.

Analysis: This cargo is volume-dominant. They have “cubed out” the container.

20ft FCL Cost per m³: ¥170,000 / 28 m³ = ¥6,070 / m³.

40ft HC FCL Cost per m³: ¥226,000 / 67 m³ (max) = ¥3,350 / m³.

Conclusion: The 20ft container is dramatically inefficient. This importer should be using a 40ft High-Cube container to ship more goods at a 45% lower unit-volume cost.

Scenario C: The LCL (Startup Importer)

Profile: E-commerce startup with irregular, low-volume shipments.

Cargo: 6-8 m³ per month, 2-3 tons.

Analysis:

20ft FCL Cost per m³: ¥170,000 / 8 m³ = ¥21,250 / m³.

LCL Cost per m³: ¥45,000 / 8 m³ = ¥5,625 / m³.

Conclusion: It’s not even close. LCL is the only logical choice. This importer should not even consider FCL until their monthly volume consistently exceeds 15-20 m³.

7. Sourcing, Suppliers, and Procurement Considerations

This guide focuses on shipping, but importers also source the physical containers.

Options: You can buy new (¥375k-500k), buy used, or lease long-term (¥25k-35k/month).

Supplier Types: In Japan, suppliers like DAX-PROS, Musashino-Kamotsu, and RONYC offer new, used, and one-way import containers.

Price Variability: Prices for the same new 20ft container can vary by 10% (¥37,000) due to manufacturing location, color options, certification level, and inventory.

Evaluation: When choosing, look at lead times, nationwide delivery, and value-added services, not just the sticker price.

8. Real-World Case Studies: Strategic Decision Frameworks

Instead of more scenarios, here are the strategic frameworks you should adopt based on your company’s scale.

Fallstudien Study 1: The Established Mid-Size Importer (10-50 containers/month)

Recommendation: Your default should be 40-foot containers. Use 20ft containers only as a specialized tool for heavy-weight, low-volume cargo, or time-sensitive orders that don’t fill a 40ft.

Expected Savings: 5-8% annually by optimizing containerization.

Case Study 2: The Growing SME (2-10 containers/month)

Recommendation: Implement a hybrid strategy. Start with LCL. As your volume consistently exceeds 20-25 m³ per month, transition to 20ft FCL. As you exceed 40 m³, transition to 40ft containers.

Expected Savings: 10-15% reduction over a pure LCL approach.

Case Study 3: The New/Startup Importer (1-3 shipments/month)

Recommendation: Maintain strict LCL focus. Do not be tempted by a “cheap” 20ft FCL quote. The total cost will be higher. Only consider FCL when your volume consistently exceeds 25 m³ per month.

Expected Efficiency: Lowest possible per-unit cost by avoiding FCL overhead.

Schlussfolgerung

The decision to use a 20-foot container from China to Japan is one of the most critical (and most misunderstood) in logistics.

Summary of Key Insights:

The 20-Foot Paradox is Real: The 20ft container is cheaper in absolute terms but less efficient per cubic meter than a 40ft container.

TCO is Everything: The ocean freight is only 40-50% of your bill. High fixed costs in Japan (drayage, THC) penalize the smaller 20ft container.

It’s a Specialized Tool: 20ft FCL is the correct choice only for heavy-weight cargo or for importers in the 25-33 m³ volume sweet spot.

Stop asking, “What is your 20-foot container rate?” Start asking, “What is the most cost-effective shipping method for my cargo based on its specific weight, volume, and frequency?”

Ground your container choices in a quantitative analysis of your weight-to-volume ratio and total cost of ownership.

FAQ

The total cost typically ranges from ¥180,000 to ¥320,000. This includes ocean freight (¥30k-60k), port charges in China and Japan (¥60k-90k), customs/broker fees (¥20k-40k), and domestic drayage (¥30k-80k).

Only in its headline price. On a per-cubic-meter basis, the 20ft is more expensive. (20ft cost: ¥1,100-1,300/m³ vs. 40ft cost: ¥730-900/m³). It is only cost-effective for heavy, low-volume cargo.

The total timeline is 10 to 18 business days from factory to your facility. This includes 1-2 days for export, 4-7 days for ocean transit, 2-5 days for customs clearance in Japan, and 1-3 days for final drayage.

The biggest ones are: Customs inspection fees (¥15,000-50,000 if selected), demurrage (late-pickup fees, ¥3k-5k/day), and peak season surcharges (+10-25%).

Use LCL if your monthly volume is < 15 m³. Use 20ft FCL if your volume is consistently > 25 m³. If you are in the “gray zone” (15-25 m³), you must calculate the cost for both options.

The mandatory documents are: Commercial Invoice, Packing List, Bill of Lading (B/L), and a Certificate of Origin (C/O) if you are claiming preferential tariffs under RCEP or CPTPP.

The HS code determines your tariff (duty) rate. A 5% tariff on a ¥200,000 CIF value adds ¥10,000. Misclassification is costly, triggering penalties (up to 35% of duty owed) and shipment delays.

Base ocean freight rates are: Shanghai to Yokohama (~$600), Shanghai to Osaka (~$550), and Shenzhen to Osaka (~$620). These are base rates only and do not include the TCO charges detailed above.

Ready to strat your China-Japan Shipping?

Thank you for reading!

Have questions, corrections, or better ideas? We’d love to hear from you!

We value every piece of feedback and promise to reply within 24 hours. Let's make this guide better together!

Note: Spam comments will not be published.