CIF from China to Japan: The Complete Buyer’s Guide for International Shipping

By Guanwutong / November 2, 2025

Let’s start with a hard truth: When importing goods from China to Japan, the trade term you choose can be the difference between a profitable shipment and a costly, complex nightmare.

CIF (Cost, Insurance, and Freight) from China to Japan often looks like the easiest, most “hands-off” option. Your supplier handles the freight, they handle the insurance… what could go wrong?

This simple assumption is where thousands of dollars are lost.

Many importers, especially those new to the field, don’t fully understand what CIF shipping from China to Japan truly entails. They don’t know where their risk actually begins, what “minimum insurance” really covers, or how it exposes them to massive hidden costs at the destination port.

This is not just another definition of an Incoterm. This is a complete buyer’s guide. We will break down everything you need to know about using cost insurance freight from China to Japan—including actual cost breakdowns, the critical risk transfer point, Japanese tax calculations, and how to decide if CIF is truly the right move for your business.

Whether you’re a first-time importer or an experienced trader, understanding this critical Incoterm will directly impact your profitability and supply chain efficiency.

1. What is CIF from China to Japan?

Definition & Core Concept

CIF (Cost, Insurance, and Freight) is one of the official Incoterms (International Commercial Terms) that defines the seller’s and buyer’s responsibilities in an international trade contract.

When you agree to CIF from China to Japan, your Chinese supplier is responsible for paying for three essential things to get your cargo to a named Japanese port (like Tokyo, Yokohama, or Kobe):

Cost (C): The value of the products you purchased.

Insurance (I): A minimum level of marine cargo insurance to cover the transit.

Freight (F): The ocean transportation charges to get the container from a Chinese port to the Japanese port.

This is the most critical distinction, and one that is frequently misunderstood:

Important Distinction: While the seller pays for freight and insurance all the way to Japan, your risk as the buyer begins the moment the goods are loaded “on board” the vessel at the origin port (e.g., Shanghai, Shenzhen, or Ningbo). If the ship sinks in the middle of the ocean, it is your financial loss, and your only recourse is the (often minimal) insurance policy the seller purchased.

CIF vs Other Trade Terms

How does CIF stack up against other common terms like FOB (Free On Board) or CFR (Cost and Freight)? This comparison is essential for any importer.

For any questions, feel free to contact GWT Shipping. Our team will provide professional, standards-compliant advice tailored to your specific needs.

2. CIF from China to Japan: Real Shipping Costs Breakdown

When you receive a CIF quote, that price is not your final landed cost. It’s just the beginning. To understand your true profitability, you must calculate your Total Landed Cost.

Typical Cost Components

Here is what your total cost will include when shipping CIF from China to Japan:

Product Cost: Your purchase price from the Chinese supplier.

Ocean Freight (e.g., Shanghai/Shenzhen to Tokyo/Yokohama/Kobe): This is included in the CIF price. Typical rates are $275-$900 per 20ft container dan $450-$1,500 per 40ft container.

Marine Insurance: Also included in the CIF price. This is typically 0.5% to 1.5% of the total CIF value.

Port Handling Charges: These are generally included in the freight quote paid by the seller.

Japanese Customs Duties: This is your responsibility. It can be 0-15% depending on the HS code of your product.

Japanese Consumption Tax: This is your responsibility. It is 10% and calculated on top of the (CIF value + customs duty).

Local Clearance & Delivery (Japan): This is your responsibility. It includes customs brokerage fees, deconsolidation (if LCL), and inland transport to your warehouse.

Real Cost Example: Importing Electronics from China to Japan

Let’s run a real-world scenario. You are importing $50,000 worth of electronics in a 40ft container.

Rate & Currency Caveat: The following freight rates are estimates as of late 2025 for illustration only. Ocean freight is highly volatile and driven by global demand, carrier capacity, and fuel costs. Always get a current quote for your specific shipment.

As you can see, the price you pay your supplier ($51,265) is nearly $12,600 less than the actual cost to get the goods to your door. You must account for this gap.

Estimate Your True Landed Cost (Template)

These calculations can be overwhelming. To avoid surprises, it’s essential to map out every potential cost. A simple spreadsheet can save you thousands.

We recommend using a CIF Cost Calculator Template that includes line items for:

Product Cost

CIF Price

Estimated Duty Rate (HS Code lookup)

10% Consumption Tax

Customs Brokerage Fee

Destination Port/THC fees

Inland Trucking

Contact our team to request a free CIF Comparison & Costing Checklist to help you map out these expenses for your next shipment.

3. How Does CIF from China to Japan Actually Work?

Here is the step-by-step process you will experience when you agree to a CIF from China to Japan shipment.

Step-by-Step Process

Negotiation & Contract: You and your Chinese supplier agree on CIF terms for the shipment to a specific Japanese port (e.g., “CIF Tokyo”).

Production & Preparation: Your supplier manufactures the goods and prepares all necessary export documentation (Commercial Invoice, Packing List).

Freight Arrangement: The seller contacts their freight forwarder to book ocean freight and purchase a marine insurance policy.

Port of Loading: The goods are delivered to the Chinese port (Shanghai, Shenzhen, etc.) and loaded onto the vessel.

CRITICAL RISK TRANSFER POINT: The moment the container is loaded “on board” the vessel, the risk officially becomes yours (the buyer).

Ocean Transit: The vessel travels for 7-14 days to reach the Japanese port.

Arrival at Japanese Port: The goods arrive. The seller’s obligations are now complete.

Your Responsibility Begins: You (or your customs broker) take over. You are responsible for filing the import declaration, paying all duties and taxes, and arranging for the final delivery from the port to your warehouse.

Key Timeline & Milestones

That critical point—while the ship is still docked in China—is the core of CIF. This visual timeline reinforces where your responsibility begins.

4. CIF from China to Japan: Risk & Responsibility Analysis

This is the section most importers wish they had read before their first CIF shipment. The separation of cost and risk is the most confusing part of CIF from China to Japan.

Understanding Risk Transfer in CIF

Let’s be perfectly clear about what you are and are not responsible for.

Seller’s Responsibility (Until Loaded On Board):

Product quality and any defects from the factory.

Damage that occurs during inland transport from their factory to the Chinese port.

Damage that occurs during the loading process onto the ship.

Ensuring all export documentation is accurate.

Your Responsibility (From Loading On Board Onward):

Any and all damage during ocean transit. This is why the insurance is included.

Damage that occurs during unloading at the Japanese port.

Any customs clearance delays, rejections, or inspection fees in Japan.

Final delivery from the Japanese port to your warehouse.

Practical Implication: If the ship encounters a storm and your container is lost or damaged, you cannot go back to your Chinese seller and demand a refund or replacement. They fulfilled their obligation. Your only recourse is to file a claim against the marine insurance policy they purchased on your behalf.

The ‘Minimum Insurance’ Trap: ICC (C) vs. ICC (A)

This brings us to the insurance itself. Under CIF terms, the seller is only obligated to purchase the minimum level of coverage, which is Institute Cargo Clauses (C).

ICC (C) is very basic. It generally only covers major catastrophes like the ship sinking, fire, collision, or general average.

It often does NOT cover common issues like:

Theft or pilferage

Water damage from rain or rough seas

Damage from a container being dropped or mishandled during transit

Your Solution: You have the right to request your supplier to purchase higher coverage, such as Institute Cargo Clauses (A), which is an “all-risk” policy.

This is a critical negotiation point. The cost difference is often minimal (perhaps an extra 0.1% – 0.3% of the cargo value), but the difference in protection is massive. A professional partner will always highlight this option for you.

5. When to Choose CIF from China to Japan (vs FOB)

So, with these risks, why would anyone choose CIF from China to Japan? Because in the right situation, it is the correct choice. The key is knowing the trade-offs.

CIF Makes Sense When:

- You are a first-time importer or lack shipping experience.

- You want simplified logistics and prefer the seller to handle the headache of booking freight.

- You prefer the seller to manage the insurance arrangements (but you must specify ICC (A) coverage).

- You want one clear, bundled price from your supplier (even if it’s higher).

- Your shipments are relatively small or infrequent (under 5 containers/month).

FOB is Better When:

- You are an experienced importer with established logistics relationships.

- You import regularly and want to negotiate freight rates directly to save money.

- You prefer to control the carrier selection, shipping routes, and transit times.

- You have existing freight forwarder partnerships in China or Japan.

- You want lower per-unit costs (FOB is typically 10-15% cheaper on the quote).

- You need flexibility in pickup timing and want to consolidate goods from multiple suppliers.

The Cost vs. Control Comparison Table

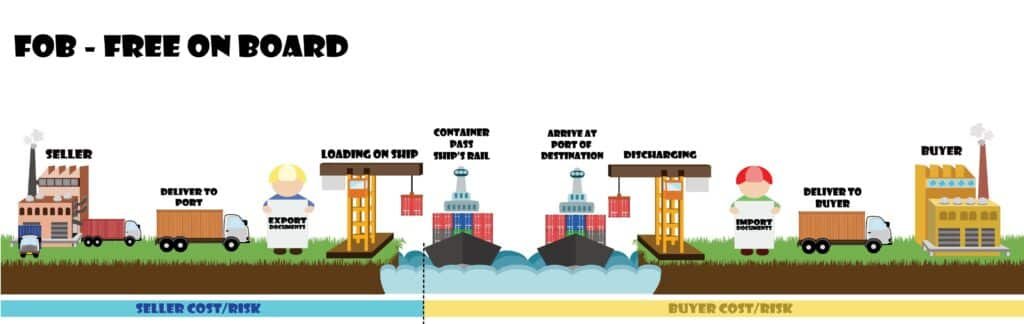

Visualizing Responsibilities: CIF vs. FOB

A visual comparison can make the choice clearer. An infographic showing the exact point where costs and risks are handed over is the best way to understand the difference.

6. CIF from China to Japan: Customs & Tax Implications

This is a non-negotiable part of importing. Under Japanese customs law, the CIF price becomes your declared value for duty purposes. Misunderstanding this can lead to penalties.

How Japanese Customs Calculates Duties on CIF Shipments

When your goods arrive, your customs broker will file a declaration. The calculation follows a strict formula:

Customs Duty = CIF Value × Applicable Duty Rate (varies by product: 0-15%) Consumption Tax Base = (CIF Value + Customs Duty) Consumption Tax = (Consumption Tax Base) × 10%

Expert Caveat: Consult a Licensed Broker Japanese customs laws, HS code classifications, and duty rates are complex, nuanced, and subject to change (e.g., anti-dumping tariffs).

These calculations are for illustrative purposes only. You must consult a licensed Japanese customs broker to get precise duty and tax calculations for your specific product before you ship.

Example Calculation

Let’s use a different scenario: You are importing textiles with a CIF Value of $40,000.

CIF Value: $40,000

Customs Duty Rate for Textiles (Example): 8%

Customs Duty: $40,000 × 8% = $3,200Consumption Tax Base: $40,000 (CIF) + $3,200 (Duty) = $43,200

Consumption Tax (10%): $43,200 × 10% = $4,320Total Tax & Duty Liability: $3,200 + $4,320 = $7,520

This $7,520 is an additional, mandatory cost you must pay upon arrival, completely separate from the $40,000 you paid your supplier.

How Japanese Customs Calculates Duties on CIF Shipments

- Under-invoicing: Asking your supplier to put a lower value on the invoice to save on duties. This is illegal, and Japanese customs will seize goods and issue severe penalties if caught.

- Misclassifying products: Using the wrong HS code to get a lower duty rate. This will lead to delays, re-assessments, and fines. Always verify your product’s 10-digit HS code against the current official Japanese Customs tariff schedule or have your customs broker confirm it before shipping.

- Forgetting Consumption Tax: Not accounting for the 10% Japanese consumption tax in your profit margin calculations.

7. Documentation Required for CIF Shipping from China to Japan

A smooth customs clearance process depends entirely on accurate and complete documentation. Missing one document can halt your entire shipment.

Critical Documents List

Commercial Invoice: Lists all products, quantities, and the final CIF price.

Packing List: Details the contents, weight, and dimensions of each carton.

Bill of Lading (B/L): The “title” to your goods. It proves ownership and must state the CIF terms.

Certificate of Origin: Proves the goods were manufactured in China, which can affect duty rates.

Insurance Certificate: Proof that the marine cargo insurance was purchased (and ideally, shows ICC (A) coverage).

Import Declaration (Japan): Your customs broker prepares and files this upon arrival.

Quality/Compliance Certificates: If required for your product (e.g., food, chemicals, electronics).

8. CIF from China to Japan: Hidden Costs & Hidden Savings

our CIF quote is not your final price. When using CIF, the buyer is particularly vulnerable to “hidden” fees at the destination port, as the seller’s freight forwarder (who you don’t know) passes their charges to a local agent in Japan.

Costs Often Overlooked

How to Reduce Your Overall CIF Costs

Even with CIF, you have options to save money:

Negotiate Insurance: Insist on ICC (A) coverage at a fair price.

Request Transparent Fees: Ask your supplier to have their forwarder provide a breakdown of estimated destination charges. A good partner will do this.

Time Your Shipments: Avoid the peak season (Q4, before holidays) when freight rates skyrocket.

Build Relationships: Long-term suppliers are less likely to cut corners on insurance or use bad forwarders.

9. Practical Advice for First-Time Importers Using CIF from China to Japan

If you’ve decided CIF from China to Japan is right for you, follow this checklist to protect yourself.

Pre-Shipment Checklist

- Confirm CIF terms in writing with your Chinese supplier.

- Verify the insurance coverage level. Explicitly request ICC (A) “All-Risks” coverage and get it in writing.

- Request the supplier get insurance with +10% coverage. This industry standard covers your lost profit, not just the product cost.

- Ensure the Bill of Lading (B/L) names YOU (or your company) as the consignee or notify party.

- Request a copy of the insurance certificate before the ship sails.

- Arrange a Japanese customs broker before the goods arrive. Do not wait.

Upon Arrival in Japan

- Receive B/L: Your supplier will send you the Bill of Lading (or a telex release).

- Contact Your Broker: Immediately forward all documents (B/L, Invoice, Packing List, Insurance Cert.) to your customs broker.

- Prepare for Payment: Your broker will prepare the import declaration and send you an invoice for the duties and taxes.

- Pay Duties & Taxes: Pay this immediately. Customs will not release your goods until this is paid.

- Arrange Final Delivery: Once cleared (usually 24-48 hours), coordinate with your broker or a trucking company to pick up the container and deliver it to your warehouse.

10. When CIF from China to Japan Goes Wrong: Troubleshooting

Even with perfect planning, problems happen. Here’s how to solve the most common ones.

Problem 1: Your cargo arrives damaged.

Solution: Do NOT sign for the delivery without noting the damage. Immediately take photos. Contact your customs broker and the insurance provider listed on the certificate. You must file an insurance claim immediately.

Problem 2: Your supplier sent missing or incorrect documents.

Solution: Contact the supplier immediately. Your shipment will be stuck at the port until the correct documents arrive. This is why you must verify documents before shipping. You will be responsible for any demurrage fees incurred.

Problem 3: The duty rate is much higher than you expected.

Solution: Your product may have been misclassified. Pay the duty to get your goods released (you must), then work with your customs broker to file a dispute or re-classification appeal with Japanese customs.

Problem 4: Your shipment is held for a random inspection.

Solution: This is normal and sometimes unavoidable. Be polite, provide any information customs requests, and factor an extra 1-3 days and $300-$500 in inspection fees into your budget.

Kesimpulan

CIF from China to Japan offers a clear trade-off: You pay a premium for simplicity and convenience, but you give up cost control and take on significant hidden risks (like minimum insurance, risk transfer at origin, and hidden destination fees).

You should choose CIF if you:

Are new to importing and value simplicity above all else.

Import infrequently (fewer than 4 times per year).

Don’t have the time or desire to build relationships with freight forwarders.

You should switch to FOB if you:

Are an experienced importer.

Import regularly (monthly or more).

Are focused on optimizing your costs and controlling your carrier choice.

Have a trusted customs broker or freight forwarder partner.

Regardless of which Incoterm you choose, your most valuable asset is a reliable partner—both your supplier in China and your customs broker in Japan.

Don’t let your profits disappear into the gray areas of CIF. Contact our team today for a transparent CIF vs. FOB comparison checklist or a no-obligation quote that breaks down all potential destination charges.

Soalan Lazim

Under CIF, the Chinese seller pays for freight and insurance to the Japanese port. Your costs are higher, but logistics are simpler. Under FOB, you take over responsibility at the Chinese port and pay for freight and insurance yourself, giving you more control and lower costs (typically 10-15% cheaper).

Ocean transit time is 7-14 days from major Chinese ports (Shanghai, Shenzhen) to major Japanese ports (Tokyo, Yokohama, Kobe). You should add 2-3 days for loading in China and 1-2 days for customs clearance in Japan, making the total process around 10-19 days.

No. CIF only covers the cost, insurance, and freight to the Japanese port. You (the buyer) are 100% responsible for paying all Japanese customs duties, the 10% consumption tax, and any local customs brokerage fees.

You must file a claim with the insurance provider. Because the risk transferred to you when the goods were loaded in China, the seller is not liable. Your only recourse is the marine insurance policy.

Yes. The CIF price is a bundle of the product cost, freight cost, and insurance cost. You can and should negotiate the total CIF price, especially if you are placing a large order.

The essentials are: Commercial Invoice, Packing List, Bill of Lading, Certificate of Origin, and the Insurance Certificate. Your supplier provides these. Your Japanese customs broker will use them to file the import declaration.

The ocean freight portion (which is part of the CIF price) is approximately $275-$900 (as of late 2025, but this is highly volatile). The insurance adds 0.5-1.5% of the goods’ value. Your total landed cost will be 15-30% higher than the CIF price after you pay Japanese duties and the 10% consumption tax.

If customs determines your HS code is wrong, they will re-classify it and issue a new, often higher, duty assessment. You will have to pay the difference, and your goods will be delayed. Repeated misclassification can lead to fines and increased scrutiny on all your future shipments. This is why using a professional customs broker is essential.

No. The CIF quote is almost always 10-15% more expensive than an FOB quote because the seller is bundling in the freight and insurance costs, often with a markup.

Ready to streamline your China-Japan logistics?

Thank you for reading!

Have questions, corrections, or better ideas? We’d love to hear from you!

We value every piece of feedback and promise to reply within 24 hours. Let's make this guide better together!

Note: Spam comments will not be published.