Meta Description: Find out the main differences between CIF and FOB terms of shipping of goods in foreign trade. Get expert advice and find out cost, obligations and the most suitable option appropriate in your enterprise.

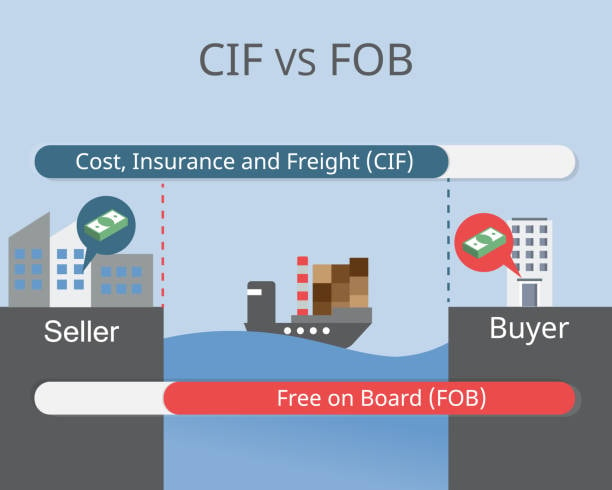

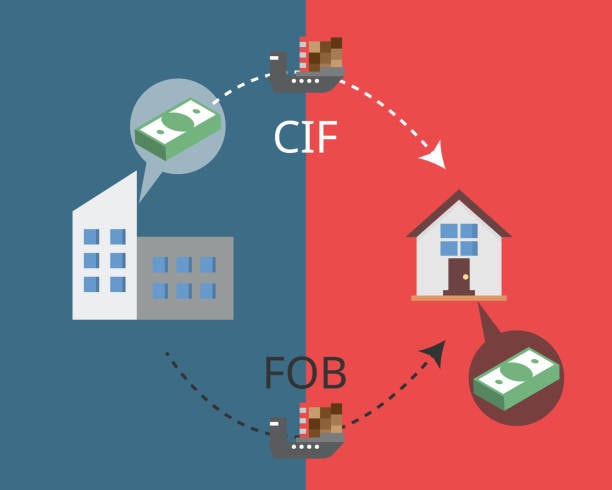

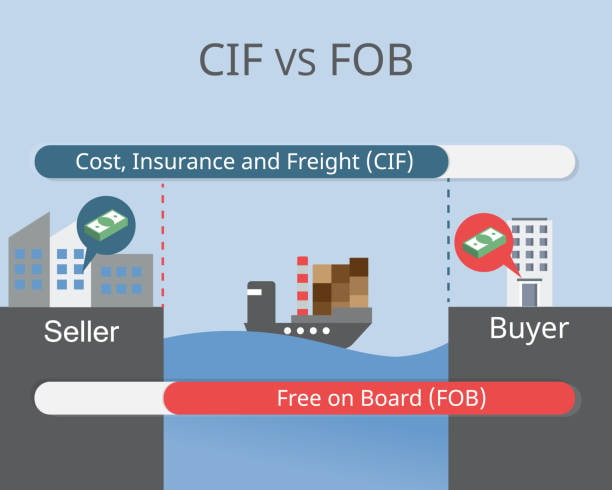

Language of the international trade may be very complicated, particularly in deciphering shipping arrangements and cost distributions. The FOB (Free on Board) and CIF (Cost, Insurance, and Freight) are two of the most widely used Incoterms in international trade shipping vessel international commercial terms. These terminologies define who is liable to the goods in transit, insurances, and other expenses involved in the international shipping process.

A decision to use FOB or CIF may have a vast implication on the bottom line of a business that deals with importation and exportation activities such as risk exposure, and efficiency in business operations shipping agreement. These terms are important in understanding so as to make informed decisions in line with your business strategy and risk tolerance purchase insurance coverage.

GWT Worldwide is a global freight forwarding company that offers supply chain solutions, cross-border e-commerce logistics services, etc. at Shenzhen Guanwutong International Freight Forwarding Co., Ltd. Our experience with pengangkutan udara, sea freight, Chinese and European rail transport, international express services, customs clearance, and the Amazon FBA shipping will assist your business to push through the intricacies of the international trading language and provide the most efficient, transparent, and costeffective logistics solutions freight collect.

Understanding FOB (Free on Board) Terms

FOB or free on Board is an Incoterm that denotes where the seller takes the responsibility of goods to the buyer at fob destination . When the FOB terms are applied, then the seller is right to deliver the goods to a specified port and place it on board the vessel freight forwarder. At the port of shipment when the goods are passed over the rail of the ship, the buyer bears any responsibility including that of transportation, insurance, prevention of loss, and damage.

The term FOB imposes little responsibility on the seller than to transport the goods to departure port safely, often affecting shipping costs destination port. This model enables buyers to have more control on the shipments arrangements with different buyers being able to choose their most desirable carriers, insurers, and logistics companies. Nonetheless, the same can be applied to the fact that buyers will also have to be knowledgeable and possess proper resource on how to effectively run international shipping operations.

FOB terms are the favorite of experienced importers who have been working with freight forwarders long enough and want to keep their supply chain within their control final destination. Buyers can generally save money with this setup by using either their high levels of shipping to negotiate a lower price than what sellers usually provide, including freight costs.

Understanding CIF (Cost, Insurance, and Freight) Terms

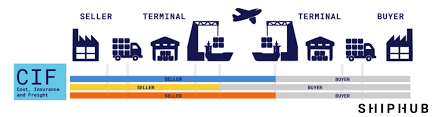

CIF Cost, Insurance, and Freight is another Incoterm where a party that sells is more accountable of the shipping process. The CIF terms require the seller to pay the cost of goods, marine insurance and freight charges against the transportation of goods to the port of the destination; hence, the seller pays for these logistics . The seller will be expected to organize and pay insurance cover to cover the interests of the buyer in transit.

The seller is involved in the making necessary arrangements of the logistics and transportation wherein he incurs the expense of transportation, but the risk of damage or loss changes to buyer when the goods are placed onboard in the port of origin fob origin. This poses an interesting situation because the seller is paying insurance whose main beneficiary is the buyer because the buyer assumes the risk in the sea voyage.

CIF terms are frequently used by the smaller importers or importers who are new in international trade and who do not have experience in handling complicated shipping arrangements. The term also offers buyers the ease of a condensed purchasing mechanism since it offers a single invoice combining the product price, transportation fee, freight prepaid, and insurance fee thus making budgeting and procurement planning very easy.

Key Differences Between FOB and CIF

The basic distinction between FOB and CIF is that under the former, there is no distribution of costs and responsibilities, whereas in the latter there is distribution of responsibility and cost. In FOB terms, buyers organize shipping operations and assume transportation charges to the port of origin and in CIF terms these duties are agreed on the seller, often adding additional fees to the overall cost . Such a divergence has implications on pricing schemes, transport costs risk burden, and operational complexity of both of the parties.

Another major difference is the cost allocation. FOB prices usually look cheap at the first instance since they avoid shipping and insurance expenses letting the buyers know what they are buying in the actual product. On the other hand, CIF prices factor in all expenditure in delivering goods to the final port of destination thus giving the buyers a complete landed cost figure that is easy to work on in terms of financial implication.

The difference between these terms in regard to control over shipping arrangements is immense. FOB purchasers are able to choose their own preffered carriers, the shipping schedule and preffered service and may get more preferable rates or shorter transit times. This control is granted to the sellers by CIF buyers who are not given the prioritized attention with regards to the particular shipping preference or the unique requirements made by the buyer.

Cost Implications and Financial Considerations

Financial analysis of whether to use FOB or CIF goes past mere comparison of prices. FOB conditions usually reduce the price of the products sold but is left to the buyer to cater their own shipping and insurances. The separation can give transparency to costs but can be cumbersome during the budgeting procedures, particularly to those companies dealing with multiple suppliers and shipments.

CIF prices are fixed and inclusive thus making financial planning and cash flow management easier. But sellers can add prices to the shipping and the insurance to cover their price of administration and exposure to cost, thus increasing the cost of products to the buyer on the whole. The attraction of consolidated billing needs to be balanced by the possible high price.

Another difference that may be brought into play by currency variation when using either term is in considering costs. FOB buyers that organize shipping on their own might have added flexibility in dealing with currency exposure of various service providers, CIF buyers on the other hand experience consolidated currency risk in their relationship with supplier.

Risk Allocation and Insurance Coverage

There is a vast difference in the risk allocation through FOB and CIF terms that influences business insurance premium and risk management plans. FOB terms place the risk on buyers when the goods are already in the ship and hence buyers are required to organize insurance cover on the goods, while seller assumes responsibility for safe delivery until that point.

The CIF terms have sellers arrange a marine insurance cover, however such a cover is usually based on offering basic cover and may not necessarily cover exactly what the buyer wants, or what the buyer is willing to take a risk to cover. In CIF terms, insurance provided by sellers is normally at CIF value of goods only and can contain clauses that cannot be accepted by buyers in their own insurance.

FOB terms are also convenient to experienced importers who can insure all their needs under a broad insurance policy coverage; however, buyer assumes responsibility for certain risks that may arise.

Documentation and Administrative Requirements

FOB and CIF transaction involve different documentation requirements in terms of complexity and distribution of responsibilities. FOB, terms involve an enormous collection of shipping documentation, such as bill of lading, commercial bill, packing lists and several documentation regarding customs matters. This administrative overhead is resource demanding, expertise-intensive, but absolutely transparent in terms of shipping process.

CIF terms make life much easier to buyers dealing with international shipping agreements since most documentation of shipping matters is dealt with by the seller who provides one package of documents. Nevertheless, this ease can be associated with a loss of visibility in the shipping area and delays that can occur in case the sellers do not have an effective documentation procedure.

The administrative burden of every term ought to be weighed on insider capabilities and resources. Seasoned logistics companies can enjoy the control and cost advantages of FOB terms whereas companies with little logistics skills can perhaps enjoy the benefits of CIF terms regardless of possible premium charges.

Impact on Cash Flow and Payment Terms

Cash flow implications: There are major differences between the cash flow implications of FOB and CIF arrangements; working capital implications and payment schedule differences. FOB terms usually entail the payment of goods and shipping services separately which may give the buyers opportunity of time and cost optimization in terms of paying the supplier. Nevertheless, due to this division, where buyer pays for shipping a precise coordination is necessary, so that shipping arrangements are coordinated with the delivery requirements.

CIF terms, the seller will incorporate in the costs that are passed to the supplier. Under cif shipping terms, the payment is consolidated through the main supplier, which makes operations of accounts payable easy, but it may need a larger advance payment in which the shipping and insurance expenses are included. This consolidation can negatively affect the cash flow of small business but it can offer simplicity in operation that may be worth the cost.

Dispute resolution and payment terms depend on the timing of the risk transfer as well. On the one hand, CIF insurance cover insures buyers in transit, but on the other hand, many buyers will not be able to claim against insurance purchased by the seller since it may be difficult to dispute the claim in case of damage or loss in the course of shipping.

Choosing the Right Term for Your Business

When choosing between FOB and CIF, it is important to take an in-depth consideration of your business strengths, risk aversion and strategy. Companies that have large amount of shipping, skilled logistics personnel and long term relations with carriers usually enjoy situations where the free on board fob terms give them control and possible lower costs in shipping.

CIF terms may be more suitable to smaller businesses or new international traders, though they may be more expensive, as it is simpler to operate and the learning process related to international shipping arrangements is shorter. The decision will have to conform to the general business strategy and operating capacity.

When computing these terms take into account the shipping rates, order volumes, transportation destinations markets, and internal logistics experience. The companies who intend to expand their cross-border activities may find it helpful to begin with CIF terms and develop the in-house infrastructure to be able to switch to the FOB terms at one point.

Regional and Industry Considerations

It can be that various industries and geographic areas prefer some Incoterms depending on tradition and infrastructure. High-quality electronics and pharmaceutical are typically sold on FOB terms, because the vendor of the goods may want to exercise close control over the handling and voyage conditions, whereas bulk commodites may usually be sold on CIF terms, because using those terms may make operations much easier to administer.

It is not unusual to have Asian suppliers, especially those in China offer FOB terms which give them limited responsibility up to the port of origin and European suppliers are more inclined to offer CIF terms, to take advantage of their mature logistic channels. The knowledge of the local preference may affect the strategy of the negotiation and supplier choice.

The practical use of these terms could also be influenced by regulatory frameworks of various countries. Certain jurisdictions impose certain specifications on insurance protection or documentation which intervenes on the operability or desirability of a particular Incoterm arrangement.

Technology and Digital Solutions

The modern technology in the logistics industry has played an important role in improving the quality of management of FOB and CIF terms as far as a business is concerned, irrespective of the terms. The digital platforms provide real-time monitoring, auto-documenting, and combined insurance, which will help alleviate some of the conventional drawbacks of every set-up.

With FOB shipments, technologies can simplify the steps of selecting carriers, rate shopping, and booking and enable the buyers to control and manage their shipping arrangements smoothly. In the same way, digital tools may add visibility to CIF buyers, increasing the transparency of the earlier opaque seller-, rather than buyer-, managed shipments relationship.

Other disruptive technologies such as blockchain will only increase the level of transparency and limit the level of disputes in international trade, and the FOB-CIF distinction may become less important all together as overall supply chain visibility increases regardless of supply chain arrangement.

Common Mistakes and Best Practices

Companies also commit serious mistakes in the application of FOB or CIF terms especially with regard to insurance and risk issue. The other mistake that most often accompanies the FOB set-up is ineffective insurance cover or slack time between the end of seller duties to the start of buyer coverage. Effective FOB implementations require proper coordination and a thorough insurance planning.

CIF arrangements are often accompanied by inadequate insurance cover because the seller offered policies might not adhere to the buyer vision and needs. Best practices list such as focusing on the terms of CIF insurance and reflecting on additional prevention policies in case of high-value or sensitive shipment.

Another trap is documentation errors, especially among those companies new to their adopted Incoterm. Insuring adequate procedures, keeping up to date documentation templates and deals with knowledgeable logistics partners can prevent time consuming and expensive errors.

Future Trends and Evolving Practices

The global trade environment remains to be changing, and digitalization, environmental issues, geopolitics have been shaping the way companies make choices regarding Incoterms to apply. The environment is also playing a more significant role where businesses are aiming at trying to minimize the length of routes and mode of shipping no matter whether they ship by FOB or CIF terms.

The existence of trade disputes and problems in supply chains has brought up the value of flexibility and alternative arrangements. Companies are also finding the ability to operate FOB and CIF as they are increasing their capability of managing the two in a situation to suit them depending on the circumstance or the situation prevailing the markets.

The development of e-commerce and the shrinking of shipments sizes is also affecting Incoterm preferences and express and courier services can provide new alternatives that break the traditional differences between FOB and CIF configurations.

Kesimpulan

The decision to use FOB or CIF horizon should be based on the abilities of your business, toleration towards risks, as well as strategic transformations. FOB terms provide more control and have the potential of cost saving at the expense of needing more expertise and resources to manage. CIF terms offer a simplified operational structure and centralized pricing without possible increase in costs and limit of control over shipping arrangements.

The choice ought to be in line with your international trade experience, shipping capacities, and the long term expansion programs outlined in the sales contract. Businesses that have well-spread logistics background usually enjoy the benefits of FOB, whereas the companies opening up to international trading or those at the initial stages of development and possessing few and fewer resources could start with CIF in their first steps.

Thank you for reading!

Have questions, corrections, or better ideas? We’d love to hear from you!

We value every piece of feedback and promise to reply within 24 hours. Let's make this guide better together!

Note: Spam comments will not be published.