Giới thiệu

In 2025, Malaysia and China continue to strengthen their economic ties, with bilateral trade growing steadily despite global uncertainties. Both countries are key players in Asia’s supply chain, and their cooperation spans manufacturing, electronics, infrastructure, and logistics. For businesses engaged in import and export, understanding these trends is essential for planning cost-efficient and resilient supply chains.

Trade Growth Between Malaysia and China

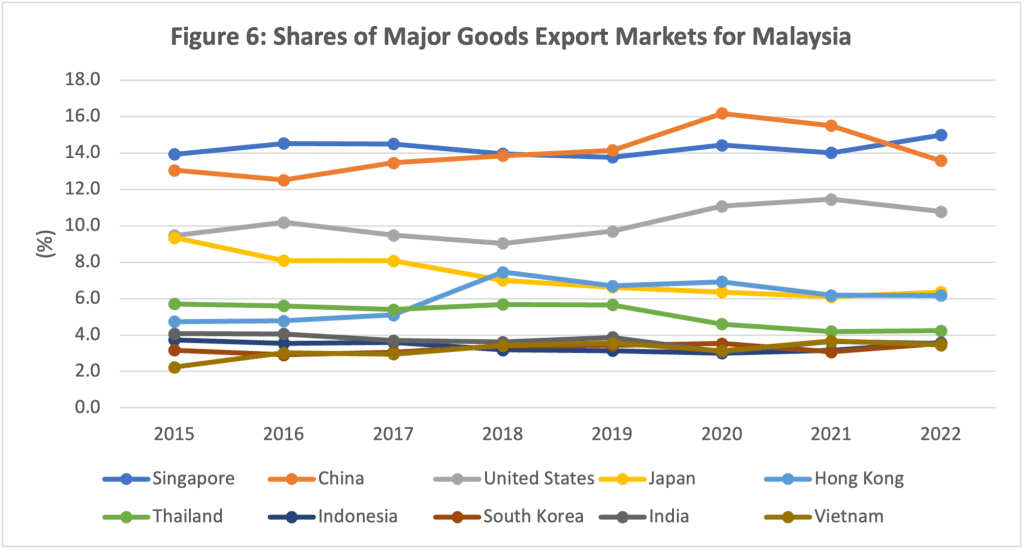

- Steady Expansion: Malaysia’s trade with China has been increasing in 2025, supported by robust imports of machinery, electronics, and raw materials. Exports to China, while experiencing minor fluctuations, remain dominated by electronic components, palm oil, and chemical products.

- Electronics as the Core Driver: Electrical and electronic (E&E) goods account for the largest share of Malaysia’s exports to China. Malaysia plays a vital role in China’s technology value chain, supplying critical components for smartphones, semiconductors, and consumer electronics.

- Balanced Partnership: While Malaysia benefits from China’s vast consumer market, Chinese exporters also use Malaysia as a strategic re-export and production hub, particularly as global trade patterns shift.

Supply Chain Integration and Specialization

China’s manufacturing ecosystem and Malaysia’s role as an electronics and palm oil exporter have become increasingly interconnected. Malaysia is positioning itself as:

- An Electronics Hub: Supplying integrated circuits, semiconductors, and precision parts that feed into China’s high-tech manufacturing.

- A Resource Supplier: Palm oil, rubber, and chemical products remain critical exports, serving China’s food, automotive, and construction sectors.

- A Regional Gateway: Malaysia’s ports and free trade zones allow Chinese companies to distribute goods across Southeast Asia efficiently.

Infrastructure and Connectivity Developments

2025 marks major progress in Malaysia’s logistics infrastructure:

- Port Expansions: Port Klang and Penang Port continue to upgrade facilities to handle larger container volumes, improving efficiency in regional trade.

- Rail Connectivity: The ASEAN rail corridor linking Malaysia, Thailand, Laos, and China is opening faster and more reliable land routes, reducing transit times compared to sea freight.

- East Coast Rail Link (ECRL): Once operational, this mega-project will significantly improve cargo movement between Malaysia’s east and west coasts, enhancing multimodal logistics.

- Inland Logistics Hubs: Dry ports near borders are being developed to facilitate customs clearance and reduce congestion at seaports.

Logistics Industry Trends in 2025

The Malaysian logistics industry is undergoing rapid transformation, shaped by both cross-border trade and domestic consumption:

- E-commerce Growth: Online retail continues to expand, boosting demand for courier, express, and parcel (CEP) services.

- Digital Transformation: Logistics providers are adopting automation, data analytics, and blockchain to improve efficiency and transparency.

- Green Logistics: With rising sustainability awareness, companies are investing in fuel-efficient fleets, renewable energy warehouses, and carbon tracking systems.

- Third-Party Logistics (3PL): Many businesses outsource warehousing and distribution to 3PL providers to reduce costs and improve service reliability.

Business Opportunities and Strategic Shifts

- Nearshoring and Relocation: Rising geopolitical risks are prompting some Chinese manufacturers to relocate or diversify production in Malaysia, strengthening bilateral logistics flows.

- Partnerships and Joint Ventures: Logistics providers from both countries are forming alliances to support supply chain integration, offering từ cửa đến cửa and multimodal services.

- Diversified Shipping Modes: Businesses are increasingly using a mix of air, sea, and rail freight to optimize transit times and costs.

- Customs Efficiency: Malaysia is improving its customs systems with digital clearance, making cross-border trade with China smoother and faster.

Summary Table

| Trend | Key Insight |

|---|---|

| Trade Growth | Bilateral trade continues to expand, led by electronics and machinery |

| Supply Chain Integration | Malaysia supplies key components and raw materials for China’s industries |

| Infrastructure Development | Ports, rail links, and inland hubs are strengthening connectivity |

| Logistics Innovation | E-commerce, digital tech, and green logistics drive industry growth |

| Strategic Partnerships | Chinese firms investing in Malaysia, boosting logistics collaboration |

Phần kết luận

Malaysia–China trade in 2025 reflects resilience, adaptability, and deeper supply chain integration. Electronics dominate the export landscape, while infrastructure projects such as rail links and port expansions are reshaping logistics. For businesses, opportunities lie in leveraging Malaysia’s role as a regional hub, embracing digital logistics, and partnering with reliable freight forwarders to ensure efficiency and compliance.

As global trade patterns continue to evolve, Malaysia and China are set to remain critical partners in Asia’s economic network, offering businesses a wealth of opportunities in logistics, manufacturing, and cross-border trade.